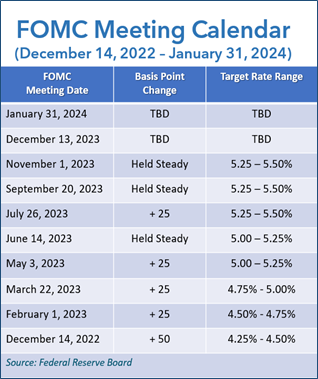

The Federal Reserve left interest rates unchanged at their meeting on November 1st. They continued to state that they are closely tracking inflation and the health of the economy to determine their future decisions. During this session, the central bank voted unanimously to leave its primary interest rate in the range of 5.25% to 5.50%. This still leaves U.S. interest rates the highest investors have seen in over 23 years.

While the Federal Reserve held interest rates steady at this session, they left the door open to a further increase in borrowing costs with a policy statement that acknowledged the U.S. economy’s surprising strength, but they also recognized the tighter financial conditions faced by businesses and households.

The Fed meets eight times a year, and it has now left rates unchanged for two meetings in a row. This has not happened since before March 2022, when they first started raising rates at a rapid pace.

In their statement, the Federal Reserve’s Open Market Committee said the economy has continued to grow at a strong pace and while the jobs market has weakened in recent months, it remains strong. They also noted that inflation remains high.

“The rise in long-term interest rates in recent months has had the same desired effect of monetary tightening, effectively doing some of the Fed’s dirty work for them,” according to Greg McBride, chief financial analyst for the financial services company Bankrate. He noted that the Fed didn’t need to raise its benchmark rate because other interest rates have continued to rise.

Interest rates on loans such as mortgages have gone up sharply over the last year, and so have payments on Treasury bonds and interest-bearing accounts. The Fed acknowledged in their statement that tighter financial and credit conditions would likely curb spending by households and businesses.

Since the Federal Reserve’s last meeting in September, new data has shown that inflation is continuing to gradually come down. While it is still not clear if inflation is coming down fast enough, or if inflation will reach the 2% annual level the Fed says it wants to see, for November, the Fed has paused their increases. The projections made by members of the Federal Open Market Committee show that policymakers think it will take until 2025 or 2026 to get inflation to the 2% level.

One of our goals as your financial professional is to maintain a watchful eye on any changes that may affect your situation. Interest rates can play a vital role in your financial planning.

Winners and Losers of Higher Interest Rates

With higher interest rates, it’s always helpful to review some of the key areas where interest rates could have a positive or negative impact.

Mortgage Rates

Mortgage rates are not determined by the Federal reserve, but its actions indirectly affect mortgage rates. As of November 2023, the Fed has raised its benchmark interest rate by a total of 525 basis points, or 5.25 percentage points, since they began raising interest rates in 2022.

In response, mortgage rates have risen by over 4.5 percentage points since the beginning of 2022. On October 31, 2023, NBC nightly news reported that in just over two years, mortgage rates have surged from 3% to 8%, which can add nearly $1,000 to the monthly payment on a median priced home.

While mortgage rates are influenced by many elements including the inflation rate, the pace of job creation, and whether the economy is growing or shrinking, the Federal Reserve’s monetary policy is a key factor in determining them. (Source: NerdWallet 11/01/2023)

Bond Holdings

Bond and interest rates move in the opposite direction. When interest rates rise, existing bond prices tend to fall, and conversely, when interest rates decline, existing bond prices tend to rise. As interest rates rise, new bond yields are likely to change.

Yield is a straightforward concept. It is the current income return you receive when, for instance, you own a bond, as measured by a percentage. If the bond you bought for $1,000 pays you $40 per year — that’s a 4% annual yield.

For example, if you invest $10,000 in a 10-year U.S. Treasury bond with a 4% yield, that interest rate is fixed even as prevailing interest rates change with economic conditions—especially the rate of inflation. Let’s say after five years you decide to sell that bond, but interest rates have risen, and now similar new bonds are now paying 5%. Obviously, no one wants to pay $10,000 for a bond yielding 4% when a higher-yielding bond costs the same. Therefore, the bond’s value will decrease.

Bonds are often considered a good option for a conservative, balanced portfolio. Although they could provide modest returns, many high-grade bonds are usually considered more stable than stocks and can provide income. Investors who put a high percentage of their portfolios in bonds with the hopes of producing stable returns need to know they could experience lackluster results when interest rates rise.

Equity Investments

Converse to bonds, interest rates do not directly affect stocks. They can, however, indirectly affect stock prices. When interest rates rise, banks increase their rates for consumer and business loans. Reduced consumer and business spending could lower the value of a stock. When interest rates are increased, this usually means that there is economic growth or strengthening.

Portfolios that are well balanced, diversified, and planned to weather volatility should also try to be well positioned to face changes in interest rates.

Savings Accounts

A rise in interest rates could be favorable for savings account and certificate of deposits (CDs) holders. Over the last year, interest rates have risen and so have the yields offered on CDs, money markets and Treasury Bills. To learn more about how you could generate higher rates on cash please call our office.

Recommendations to Consider

Since each individual has different financial goals, interest rates can affect investors differently. Having a solid financial plan, sticking to that plan, and working with a financial professional before making any decisions to sway from that plan is always advised. We offer the following basic items for consideration based on current interest rates.

- Maintain complete liquidity for all short-term and near-term needs. Liquid accounts in today’s interest rate environment can offer reasonable rates. It is always important to maintain a liquid component in your portfolio. With higher rates, this is a good time to think about what major expenses you will incur in the next two years and consider keeping a larger than typical liquid pool of assets.

- Reduce or eliminate any unnecessary debt. It is always helpful to review any debt you have, like credit card balances you might have that are at high rates. Try to see if you can and should reduce any unnecessary debt. Some debt, like a mortgage can be a part of your financial plan, but any debt that is not, should be reviewed.

- Review all your income-producing investments. As wealth managers, we help our clients review their income-producing investments. Today’s income choices are much more attractive than those offered 2 or 3 years ago. Remember, one of our primary goals is to try to match your portfolio to your timelines and personal financial situation.

- Consider duration not just yield. When reviewing your bond holdings, duration, or length of term is an important factor. Yield alone should not be the determinant in your selections. If you have questions about duration, then please call us and we can discuss your personal plan.

- Monitor your portfolio regularly. Interest rates can move quickly or slowly. We are watching the Fed and its decisions on interest rates so we can suggest adjustments to your portfolio as needed in a timely and educated manner. This is something that we enjoy doing for our clients.

Closing Thoughts

Interest rates can be complex. Trying to guess interest rate movements could prove to be risky. Skillful investors always pay most attention to their own personal situations.

As mentioned earlier, we keep a watchful eye on interest rates and how they may affect our clients. In today’s interest rate environment, we are monitoring your investments with us. If you have any questions or would like us to review your specific situation, please let us know.