Search

Archives

Categories

Recent Posts

Important IRS Update: Significant Interest Penalty Increase for Tax Underpayments

The Internal Revenue Service (IRS) has recently announced a critical change that could significantly impact taxpayers who underpay their taxes. This update is particularly relevant as we approach the next tax filing season. Previously, the IRS charged a 3% interest penalty on estimated tax underpayments. However, this rate has now been increased to a substantial

Read More

Will Inflation Hurt Stock Returns? Not Necessarily

Investors may wonder whether stock returns will suffer if inflation keeps rising. Here’s some good news: Inflation isn’t necessarily bad news for stocks. A look at equity performance in the past three decades does not show any reliable connection between periods of high (or low) inflation and US stock returns. Since 1993, one-year returns on

Read More

Maximize Your Charitable Impact with These Four Strategies

As the year draws to a close, it’s a perfect opportunity to rethink how you give to charity. This is important for managing how much tax you pay and how much help reaches those in need. Here are four effective strategies: Need Guidance? Reach Out to Us! These strategies are just a starting point. There

Read More

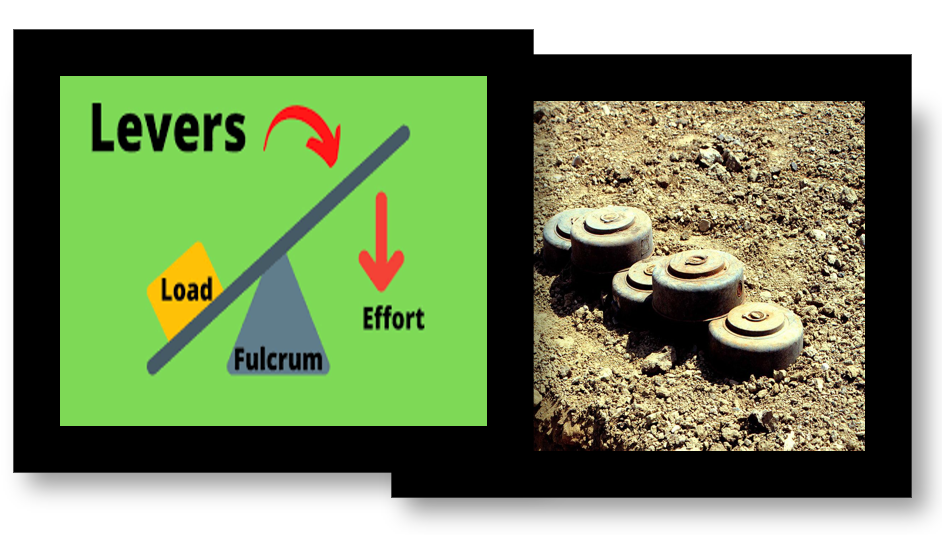

Levers and Landmines of Annuity Products

Unlock the Power of Annuities and Sidestep Potential Pitfalls with Shah Total Planning

Annuity products have become increasingly popular among individuals planning for retirement or looking to generate a steady stream of income. Like all financial products, annuities come with both enticing levers and precarious landmines. In this blog post, we will delve into the mechanics of annuities, weigh their pros and cons, and provide you with a roadmap to navigate them efficiently.

The Levers: Beneficial Aspects of Annuities

1. Guaranteed Income Stream

Annuities can provide a steady stream of income for a specified period or even for life. This can offer a safety net, especially during retirement, and safeguard against outliving your savings.

2. Tax Deferral

The earnings in an annuity accumulate tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw the funds. This can result in significant tax savings.

3. Customization and Flexibility

Annuities often offer a range of options for payouts, investments, and riders. This allows you to tailor the product to your specific needs and risk tolerance.

The Landmines: Potential Pitfalls of Annuities

1. Complexity and Fees

Annuities can be complex, with an array of features and fees that can be confusing. The expenses can eat into your returns and diminish the benefits if you are not vigilant.

2. Surrender Charges

Many annuities have surrender charges, which are fees you must pay if you withdraw funds before a certain period. This can make annuities less liquid and flexible than other investment options.

3. Market Risk and Return Caps

Some annuities, like variable annuities, are exposed to market risk. Also, indexed annuities may have caps on returns, limiting the amount you can earn in a strong market.

Navigating Annuities: Partner with Shah Total Planning

Understanding the levers and landmines of annuity products is critical to making informed decisions that align with your financial goals. Shah Total Planning offers a comprehensive suite of services to help you unlock the full potential of annuities while deftly navigating the possible pitfalls.

Our experienced financial advisors at Shah Total Planning can:

- Assist in evaluating your financial goals and risk tolerance.

- Help you understand the different types of annuities and their features.

- Guide you in selecting the right annuity product and customizing it to fit your needs.

- Monitor and manage your annuity investments, making adjustments as necessary.

With the expert guidance of Shah Total Planning, you can harness the power of annuities to build a secure financial future while sidestepping the landmines.

Call to Action

Don’t leave your financial future to chance. Take the reins by understanding and effectively employing annuity products in your investment strategy. Connect with Shah Total Planning today to map out a path that leads to a financially secure tomorrow.

Get Started with Shah Total Planning

Your future is too important not to plan for. Shah Total Planning is committed to helping you make the most of your financial resources and guiding you towards a successful retirement.