Search

Archives

Categories

Recent Posts

Important IRS Update: Significant Interest Penalty Increase for Tax Underpayments

The Internal Revenue Service (IRS) has recently announced a critical change that could significantly impact taxpayers who underpay their taxes. This update is particularly relevant as we approach the next tax filing season. Previously, the IRS charged a 3% interest penalty on estimated tax underpayments. However, this rate has now been increased to a substantial

Read More

Will Inflation Hurt Stock Returns? Not Necessarily

Investors may wonder whether stock returns will suffer if inflation keeps rising. Here’s some good news: Inflation isn’t necessarily bad news for stocks. A look at equity performance in the past three decades does not show any reliable connection between periods of high (or low) inflation and US stock returns. Since 1993, one-year returns on

Read More

Maximize Your Charitable Impact with These Four Strategies

As the year draws to a close, it’s a perfect opportunity to rethink how you give to charity. This is important for managing how much tax you pay and how much help reaches those in need. Here are four effective strategies: Need Guidance? Reach Out to Us! These strategies are just a starting point. There

Read More

Business Planning Strategies

Business planning can comprise many areas but for purposes of this overview, we’ll be focused on two key areas: Business succession and exit planning & Attracting and retaining key employees.

Succession Planning

At its heart, succession planning is about how to operate, grow and ultimately transfer the business interests. The benefits derived from succession planning are not only ensuring a smooth transition of ownership but also:

- Reducing the probability and the magnitude of the loss of value associated

with unexpected events. - Providing a sense of security for all stakeholders involved in the business.

- The potential for tax savings.

Proper succession planning involves these elements:

Family Business Strategies

Often, an objective of family-owned businesses is to extract enough value

from the business for the senior family members to guarantee income

without generating capital gains taxes, while simultaneously transferring

business interests to the younger generations. A couple techniques to

accomplish that are:

- Installment sales to irrevocable grantor trusts — A means by which

to give the younger generation ownership without simply making

outright gifts and for the senior generation to obtain value or income

for some of the assets over time. This is achieved by selling the business

shares to a trust for a note for a term of years for principal and interest.

The sale does not create income tax but does provide the shareholder

income, and the children are the beneficiary of the trust. - Recapitalizing into various share classes — A way to create

different share classes with different results. For example, create

preferred shares that pay out a fixed dividend with no capital

appreciation, and have a second class of shares, called common shares,

that all capital appreciation accrues to and which are generally owned

by junior family members.

Key Questions to Consider When Selecting a

Business Succession Strategy:

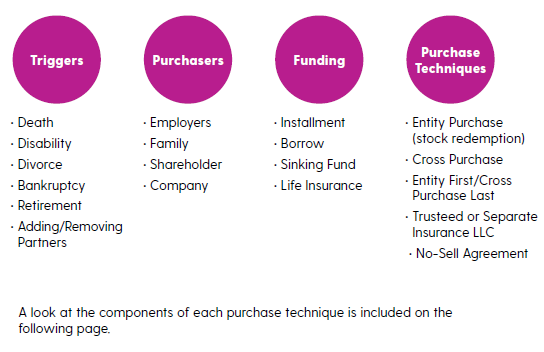

If you have an operating or buy-sell agreement in place: - What triggers the transfer of business interests (e.g., death, disability,

divorce, bankruptcy, retirement, adding or removing partners)? - How is a transfer caused by a triggering event to be funded?

- Are any family members or employees slated to become owners

in the future?

If there is no operating or buy-sell agreement: - What is the vision for how to actualize value from the business for

yourself or your family upon any triggering event?

Attracting and Retaining Key Employees

To meet the goals of both the employee and the business, incentives must align with cash flow while maximizing tax deductions and deferring employee taxation. An effective strategy can offer attractive supplemental retirement income as an alternative to transferring business equity to the employee.

Qualified Plans

(The benefit package meant to include most employees)

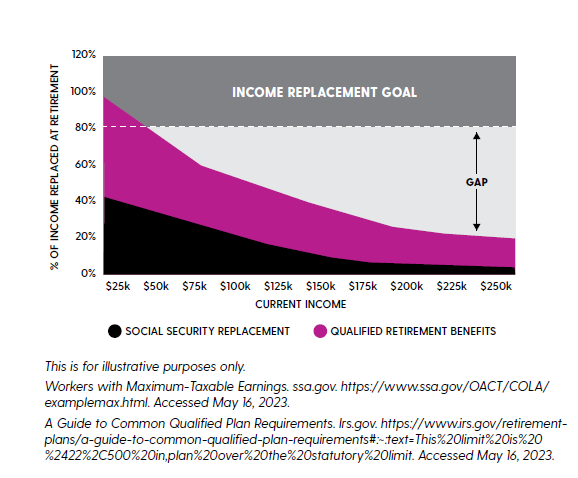

These plans enable a deduction and deferral of current taxable salary to save for income in retirement. Defined contribution plans are based on a specified contribution amount, whereas defined benefit plans are based on a targeted benefit in retirement. Amounts contributed to retirement plans may be limited by disparity tests, which ensure plans don’t favor only the highly compensated. This is one of the reasons to use non-qualified plans in tandem with qualified plans for highly compensated employees.

- Defined Contribution Plans (e.g., 401(k))

- Defined Benefit Plans

- Hybrid Plans (e.g., Cash Balance)

Non-qualified Plans - (Deferred compensation designed specifically for highly compensated employees)

Similar to qualified plans, non-qualified plans can have vesting schedules and can be structured as either a defined contribution or a defined benefit

plan. Non-qualified plans are generally thought of as supplemental — current or future income that does not meet the standards the IRS has for a qualified plan. These plans can help highly compensated employees

fill the gap between what they need in retirement and what is available through qualified plans.

Uses For Non-Qualified Plans:

- Equity alternative: an alternative to giving direct ownership to employees.

- To replace lost earnings to the business if key employees were to leave and to cover

costs of replacing them. - To attract new, high value employees.

Funded or Non-Funded: Non-qualified plans are liabilities of the corporation, which can be

funded currently or delayed as a future liability of the corporation without funds currently set

aside. The purpose of a non-qualified plan generally is to attract and retain employees, and

funded plans are more attractive to employees versus a non-funded promise of the company.

Examples of methods for funding such plans are - Life Insurance: Life insurance is often used as a funding mechanism for bonus plans

of various types in order for the business to have tax deferral on amounts set aside for

liabilities created by non-qualified plans. Additionally, life insurance allows employees to

change investment allocations without causing current taxation to the employer. - Marketable Securities (mutual funds and fixed income)