Search

Archives

Categories

Recent Posts

Important IRS Update: Significant Interest Penalty Increase for Tax Underpayments

The Internal Revenue Service (IRS) has recently announced a critical change that could significantly impact taxpayers who underpay their taxes. This update is particularly relevant as we approach the next tax filing season. Previously, the IRS charged a 3% interest penalty on estimated tax underpayments. However, this rate has now been increased to a substantial

Read More

Will Inflation Hurt Stock Returns? Not Necessarily

Investors may wonder whether stock returns will suffer if inflation keeps rising. Here’s some good news: Inflation isn’t necessarily bad news for stocks. A look at equity performance in the past three decades does not show any reliable connection between periods of high (or low) inflation and US stock returns. Since 1993, one-year returns on

Read More

Maximize Your Charitable Impact with These Four Strategies

As the year draws to a close, it’s a perfect opportunity to rethink how you give to charity. This is important for managing how much tax you pay and how much help reaches those in need. Here are four effective strategies: Need Guidance? Reach Out to Us! These strategies are just a starting point. There

Read More

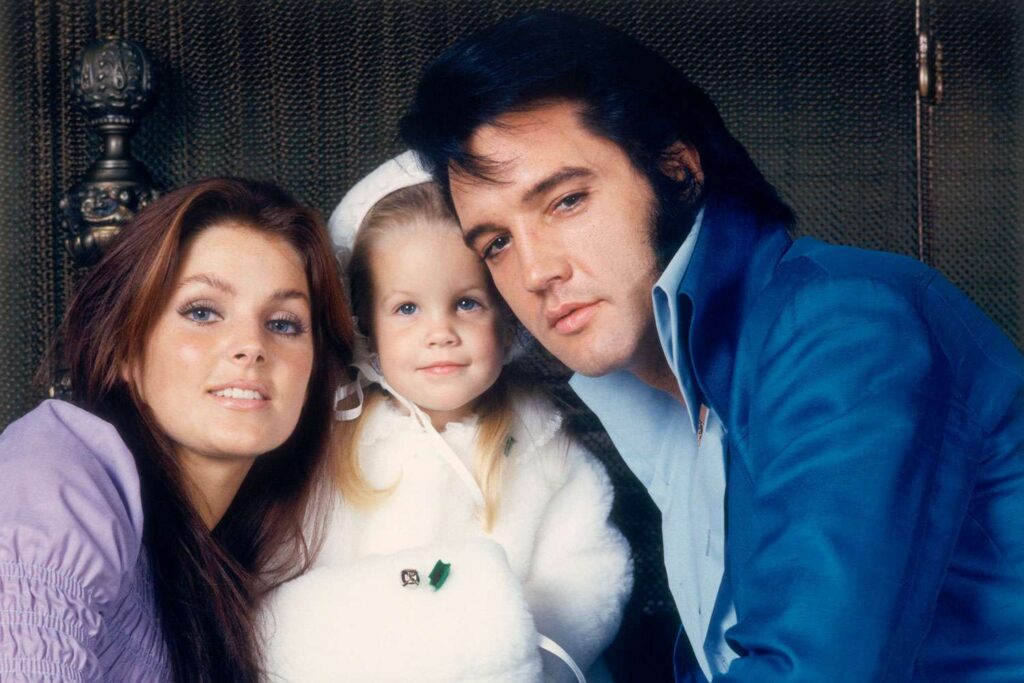

Estate Planning Mistakes of Lisa Marie Presley

Lisa Marie Presley is the daughter of music legend Elvis Presley and has inherited his fortune, estimated to be worth around $71 million. However, despite her wealth, Presley has made some estate planning mistakes that have led to a complicated and public legal battle.

One of Presley’s main mistakes was failing to regularly update her estate plan. In 2012, she had a comprehensive estate plan prepared, but did not update it despite major changes in her life, such as divorces and the birth of two children. As a result, when Presley passed away in 2023, her estate plan did not reflect her current wishes and family circumstances.

Another mistake made by Presley was not properly funding her trust. She established a trust, but failed to transfer her assets into it. This meant that her assets did not pass through the trust, and instead were subject to the probate process, which is costly and time-consuming. Additionally, this meant that her assets were not protected from creditors or other legal claims.

Presley’s estate planning mistakes have resulted in a lengthy and public legal battle, which could have been avoided if she had taken the time to update and properly fund her estate plan. This serves as a reminder of the importance of regularly reviewing and updating estate plans to reflect changes in personal circumstances and the law, as well as properly funding trusts to protect assets and avoid probate.

At Shah Total Planning, we will give you all the guidance needed so that not only is your estate plan created but it can be properly funded as well.