Search

Archives

Categories

Recent Posts

Important IRS Update: Significant Interest Penalty Increase for Tax Underpayments

The Internal Revenue Service (IRS) has recently announced a critical change that could significantly impact taxpayers who underpay their taxes. This update is particularly relevant as we approach the next tax filing season. Previously, the IRS charged a 3% interest penalty on estimated tax underpayments. However, this rate has now been increased to a substantial

Read More

Will Inflation Hurt Stock Returns? Not Necessarily

Investors may wonder whether stock returns will suffer if inflation keeps rising. Here’s some good news: Inflation isn’t necessarily bad news for stocks. A look at equity performance in the past three decades does not show any reliable connection between periods of high (or low) inflation and US stock returns. Since 1993, one-year returns on

Read More

Maximize Your Charitable Impact with These Four Strategies

As the year draws to a close, it’s a perfect opportunity to rethink how you give to charity. This is important for managing how much tax you pay and how much help reaches those in need. Here are four effective strategies: Need Guidance? Reach Out to Us! These strategies are just a starting point. There

Read More

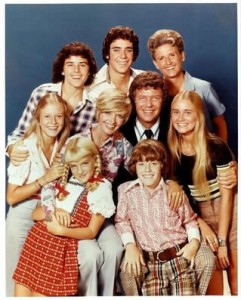

What About Blended Families?

Planning for blended families presents particular challenges when it comes to ensuring your wishes are carried out. While every situation is unique, here are a few common problems and ways to address them.

(Photo Credit: sitcomsonline.com)

Let’s say you want to disinherit your ex-spouse. At the very least, make sure you have replaced him or her as the named beneficiary of your retirement plans and other assets. You should also consider a Long-Term Discretionary Trust (LTD Trust) to administer your children’s inheritance, with a party of your choosing serving as trustee. In this way, even if your children reside with your ex-spouse, your trustee will control the inheritance through the LTD Trust and ensure it is used only for your children. Should one of your children predecease your ex-spouse, the inheritance would remain

in your LTD Trust for your grandchildren and, if there are none, for your surviving children or other beneficiaries of your own choosing.

Another useful trust is called a Qualified Terminable Interest Property Trust (QTIP Trust). It can protect your new spouse by providing income and even principal for life. It can also protect your new spouse’s inheritance in the event of a subsequent remarriage and divorce. And, upon the death of your new spouse, the QTIP Trust assets may pass to the LTD Trust you established for your own children.

To learn more about the unique planning problems associated with blended families, and how we can help address your particular concerns and goals, please contact us for a consultation.