Search

Archives

Categories

Recent Posts

Important IRS Update: Significant Interest Penalty Increase for Tax Underpayments

The Internal Revenue Service (IRS) has recently announced a critical change that could significantly impact taxpayers who underpay their taxes. This update is particularly relevant as we approach the next tax filing season. Previously, the IRS charged a 3% interest penalty on estimated tax underpayments. However, this rate has now been increased to a substantial

Read More

Will Inflation Hurt Stock Returns? Not Necessarily

Investors may wonder whether stock returns will suffer if inflation keeps rising. Here’s some good news: Inflation isn’t necessarily bad news for stocks. A look at equity performance in the past three decades does not show any reliable connection between periods of high (or low) inflation and US stock returns. Since 1993, one-year returns on

Read More

Maximize Your Charitable Impact with These Four Strategies

As the year draws to a close, it’s a perfect opportunity to rethink how you give to charity. This is important for managing how much tax you pay and how much help reaches those in need. Here are four effective strategies: Need Guidance? Reach Out to Us! These strategies are just a starting point. There

Read More

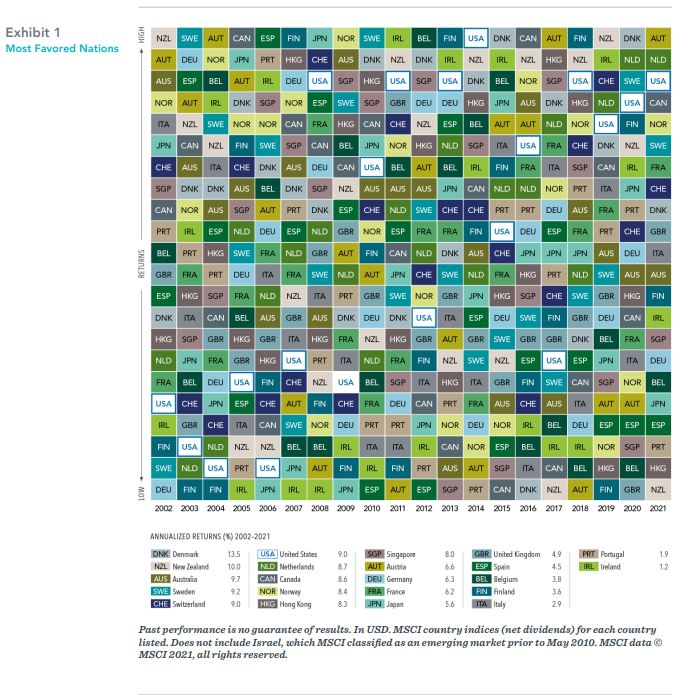

Which Country Will Outperform? Here’s Why It Shouldn’t Matter

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be outperformers. How should investors deal with this kind of uncertainty?

First, they should remember that it’s challenging, at best, to predict a country’s returns by looking at the past, as shown by the performance of global markets since 2001 (see Exhibit 1). In the past 20 years, annual returns in 22 developed markets varied widely from year to year. (Each color represents a different country, and each column is sorted

top-down, from the highest-performing country to the lowest.)

Two examples help make the point well:

• Austria posted the highest developed markets return in 2017—but the lowest the next year.

• The US ranked in the top five for annualized returns over the entire 20 years but finished first in the country rankings just once over that period. In nine calendar years, it was in the lower half of performers.

Investors can benefit from understanding that they don’t need to predict which countries will deliver the best returns during the next quarter, next year, or the next five years. Why? Holding equities from markets around the world—as opposed to those of a few countries or just one—positions investors to potentially capture higher returns where they appear, and outperformance in one market can help offset lower returns elsewhere. Put another way, a globally diversified portfolio can help provide more reliable outcomes over time.

Sources: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affiliates.